Alumina roadmap plots a path to slash Australia’s emissions

A major new report says four decarbonisation technologies, combined with renewable energy, can help the alumina industry to cut its carbon emissions by up to 98 per cent.

Did you know? Naturally occurring alumina crystals are called corundum, a mineral second in hardness only to diamond. Rubies and sapphires are corundum crystals contaminated with traces of metals.

Australia is the world’s largest exporter of alumina. In fact, the industry contributes about $7.5 billion to the national economy every year.

But it is also very energy and emissions intensive.

Each year, Australia’s six alumina refineries, four in Western Australian and two in Queensland, use more than twice the energy consumed by the state of Tasmania. Alumina refining is responsible for up to 3 per cent of Australia’s annual emissions.

But transitioning alumina refining to renewables is not easy.

A major new report, A Roadmap for Decarbonising Australian Alumina Refining, confirms both the importance of alumina refining and its difficult path to decarbonisation.

“The alumina industry plays an integral role in the Australian economy, but it is also one of Australia’s ‘hard-to-abate’ industries.”

Commissioned by ARENA with input from Australia’s three alumina producers, Alcoa, Rio Tinto and South32, and prepared by Deloitte, the roadmap says: “Four Key Decarbonisation Technologies have the potential to almost entirely eliminate alumina refining emissions in Australia.”

ARENA CEO Darren Miller described the roadmap as “an important call to action”.

“Decarbonising the alumina refining sector can further improve Australia’s international competitiveness, strengthen its position as a leading producer of low emissions alumina and aluminium and secure the jobs and economic benefits from the sector,” Mr Miller said.

What is alumina?

There are three main steps in the aluminium production value chain:

Bauxite mining: Australia is the world’s largest of producer of bauxite. Alumina production uses more than 90 per cent of the world’s bauxite. In 2021 Australia produced just over 100 million tonnes of bauxite and exported almost 40 million tonnes.

Alumina refining: Refined alumina is an oxide of aluminium and looks like refined sugar or table salt. Australia is the world’s second-largest producer of alumina and its largest exporter. Alumina is mostly used to make aluminium but it also has many other uses such as glass, porcelain and paint manufacturing.

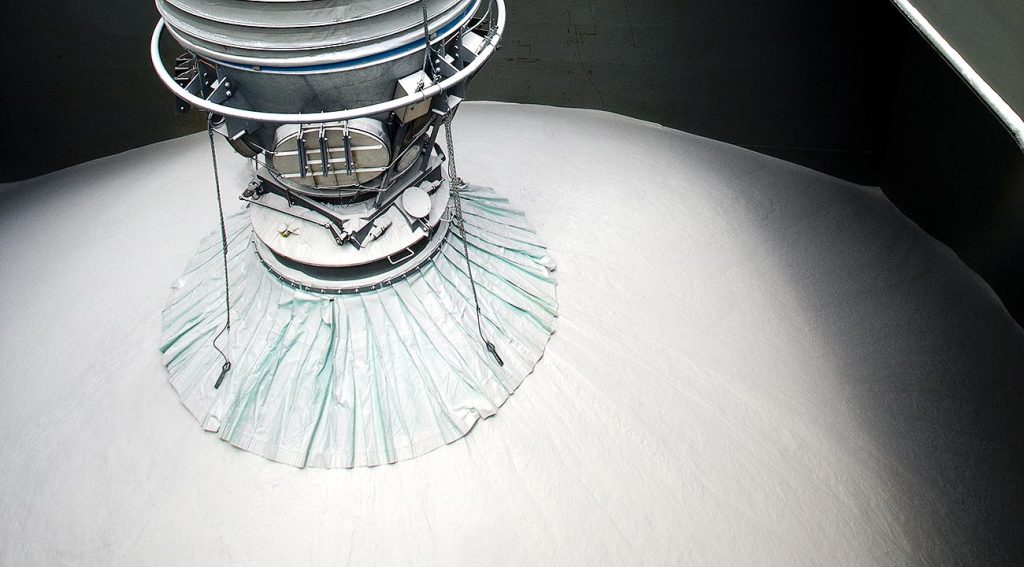

There are two key processes in an alumina refinery. Firstly, the Bayer process uses steam to extract alumina crystals from the bauxite. This consumes around 70 per cent of the energy used at the refinery. Secondly, a high-temperature calcination process removes chemically bound water from the alumina crystals. This consumes the remaining 30 per cent of energy.

Aluminium smelting: Australia is world’s sixth largest producer of aluminium. After iron and steel, it is the world’s most widely used metal with applications too numerous to mention.

Credible pathways to cutting emissions

Of the three stages, bauxite mining is by far the least energy intensive while aluminium smelting is the most, relying heavily on electricity. Emissions from aluminium smelting are expected to fall as Australia’s electricity grid transitions to renewable energy.

But alumina refining relies on fossil fuels to provide both heat and electricity. There are currently limited viable alternatives, which means the industry needs to look to innovate solutions.

The roadmap highlights credible pathways towards cutting emissions from alumina refining by up to 98 per cent.

The roadmap identifies four key technologies to reduce emissions.

Mechanical vapour recompression (MVR)

MVR replaces natural gas boilers for steam production in alumina refineries.

This process captures, recompresses and recycles waste steam that would otherwise vent to the atmosphere.

Renewable electricity powered MVR could reduce emissions in alumina refining by up to 70 per cent.

In May 2021, ARENA announced $11.3 million in funding to Alcoa to demonstrate the MVR technology at its Wagerup alumina refinery.

This $28.2 million project is a first-of-its-kind demonstration of MVR technology in Australia. If proven feasible, Alcoa will deliver a 3 MW MVR module, powered using renewable energy.

MVR could be ready to be for deployment from the late 2020s.

Electric boilers

Powered by renewable energy, electric boilers can also replace coal or gas fired boilers for steam production.

Low temperature electric boilers are a mature technology that could be deployed at some refineries before 2030.

However, there is a caveat. According to the roadmap, “Electric boilers have higher operating costs than current fossil fuel fired boilers.”

“Access to low-cost renewable electricity or other financial support mechanisms are required to make this technology economically viable.”

Providing the necessary electricity supply infrastructure and fitting it into existing sites may prove challenging.

Hydrogen calcination

Hydrogen calcination replaces the combustion of natural gas in the calcination process with the combustion of hydrogen.

Combusting hydrogen with a stream of oxygen produces a pure steam exhaust. The Bayer process can capture and reuse that steam when combined with MVR.

Switching to hydrogen calcination will require cost competitive renewable hydrogen production at scale.

ARENA is providing $580,000 funding towards a feasibility study at Rio Tinto’s Yarwun alumina refinery in Gladstone. Launched in 2021, the study is examining the case for constructing a hydrogen pilot plant and the potential use of hydrogen at the refinery.

Rio Tinto is investigating replacing natural gas with hydrogen in the calcination process, and retrofitting hydrogen burners in its existing calciners.

Hydrogen calcination is seen as a longer-term prospect, which could be ready by 2035.

Electric calcination

Electric calcination replaces coal or gas powered calciners with electric calciners powered by renewable electricity.

Removing chemically bound water from the alumina crystals also produces pure steam. In combination with MVR, a refinery can capture and reuse that steam.

However, electric calcination is at a low level of technical maturity and will require significant support to commercialise with potential deployment from 2035 onwards.

In April 2022, Alcoa announced it will demonstrate electric calcination technology at its Pinjarra Alumina Refinery. ARENA is providing $8.6 million funding support to the $19.7 million project. The Western Australian Government is also contributing $1.7 million through its Clean Energy Future Fund.

This project is a world-first demonstration of electric calcination.

Alcoa’s main objective for the project is to demonstrate the technical and commercial feasibility of using electric calcination technology powered by renewable energy.

Call to action

Mr Miller says the roadmap provides a clear vision for decarbonising one of Australia’s most emissions intensive industries.

“Alumina refining has always been considered a hard-to-abate sector with significant barriers to reducing emissions,” he said.

“Now, we have Australia’s biggest alumina producers coming together with ARENA to develop a clear and credible pathway to reducing emissions in the industry.

“With just four key decarbonisation technologies currently in development to reduce nearly all emissions from Australian alumina refineries, what we need now is coordinated investment to accelerate the commercialisation of these technologies,” Mr Miller said.

Read the Roadmap for Decarbonising Australian Alumina Report.

LIKE THIS STORY? SIGN UP TO OUR NEWSLETTER

ARENA