What are renewable energy zones, and why do they matter?

It is true that the sun doesn’t always shine and the wind doesn’t always blow, but with the right transmission infrastructure we can harness energy from a variety of sources across the country.

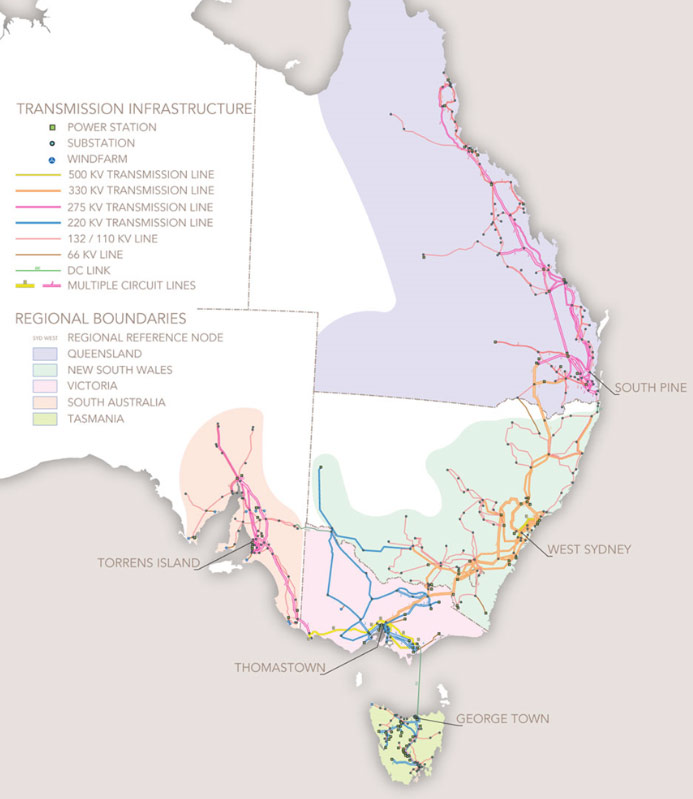

Australia is rich in renewable energy resources, but converting the potential into productive renewable energy zones is a big job. A quick glance at a map of the National Electricity Market shows how existing transmission lines connect the historical electricity generating hotspots with the nation’s large population centres.

In Victoria, connections are strong between the coal rich Latrobe Valley and Melbourne. Likewise, in Queensland and New South Wales, the capital cities are linked to the historical coal producing centres.

This is posing challenges as more of our electricity is supplied by wind and solar. While the Latrobe Valley and Hunter Valley are rich in the resources needed for coal generation, they are not as well suited to wind and solar farms.

And conditions in sunny north-west Victoria might be perfect for solar production, but with the existing transmission lines at capacity it is difficult to add new solar farms to the grid.

Work ahead to unlock renewable energy zones

There is no doubt that Australia has some of the best renewable energy resources in the world. But access to the places with the greatest potential (renewable energy zones) is being held back by limited network connections.

Unlocking the potential of these renewable energy zones is becoming more pressing. According to Bloomberg, investment in new Australian renewable energy projects fell by 60 per cent in 2019. A large part of this decline has been blamed on difficulty gaining approval to connect new projects to the grid, transmission losses, and congestion in parts of the network.

To help break through these barriers and lay the groundwork for future renewable energy projects, ARENA engaged consultants Baringa Partners to explore the challenge for renewables in constrained zones, and present solutions to manage them.

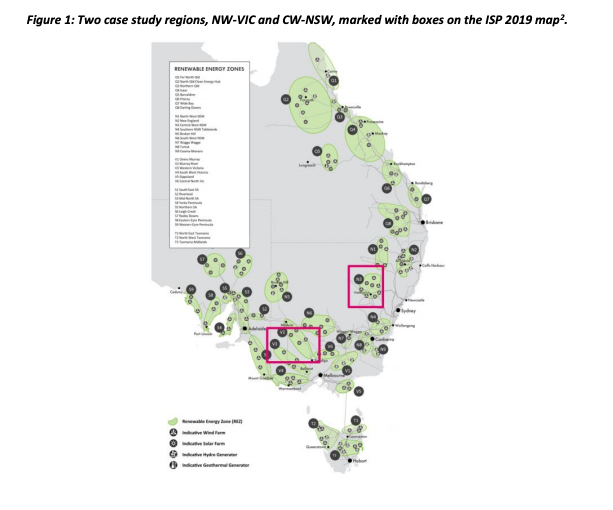

Partnering with DIgSILENT, the project worked with the Australian Energy Market Operator to model two renewable energy zones – one in north-west Victoria, and the other in central-west New South Wales. The locations are attracting interest from renewable energy developers, but each face technical challenges for new projects to connect due to the state of the existing power network.

Heat and strength the biggest barriers

For these regions, the two most significant hurdles to overcome are thermal constraints and system strength. Exceeding the limits of a transmission line can damage equipment and cause the line to physically heat up and sag, which can be unsafe and impact on its operation. If a region is low in system strength, it is less resilient to drops in voltage and more likely to see damaging voltage surges.

The study found the north-west Victorian region was severely impacted on both fronts. Until action is taken to improve system strength, there will be limited opportunities to build new renewable energy projects or reduce the risk that generation from existing plants will be curtailed.

The New South Wales example faced similar, but less severe challenges. With less renewables installed or committed, the thermal and system strength issues are less acute and there is a small amount of capacity available for new projects.

Network and technological solutions modelled

A range of possible solutions were modelled to tackle the problems. Network upgrades to poles and wires were found to be the most effective option, based on proposals within AEMO’s 2018 Integrated Systems Plan. These upgrades could unlock the most capacity for new connections, particularly in Victoria where there is currently no capacity available.

Possible technological solutions to the challenges were also modelled. Synchronous condensers, large-scale batteries and ‘smart wire’ technologies were considered and found to have potential to complement network upgrades.

The relative costs and timing of each option were compared, based on the investment needed for each kilowatt of variable renewable energy unlocked.

While in the near term the technologies assessed could unlock about 1 GW of ‘headroom’ in central-west New South Wales, a poles and wire solution could free up about 3 GW of new capacity. This comes at a lower cost per KW for the technology solutions, though with a longer time to build than other technology options. The report also notes that the price of technologies like batteries is falling, and may fall further if market reforms open new revenue streams.

In north-west Victoria the network improvements based on AEMO’s ISP and Western Victorian Regulatory Investment Test for Transmission were identified as the ‘fundamental solution’. The technologies assessed could unlock new capacity to host renewable projects, but would be unable to address the thermal constraints or risk of curtailment.

The report states there is no ‘one size fits all’ approach when the starting point can be so different between regions.

Scale of challenge may demand major reforms

The modelling indicates that commercial and regulatory changes will be needed to unlock the investment needed in network and technology upgrades. The report considers a range of options to deliver the network and technology, and models to finance their rollout.

While large-scale batteries could be implemented on a commercial basis, it is likely networks would be required to deliver technologies that don’t generate revenue through the regulated market.

There could also be a role for governments and other third parties to reduce the risks associated with network development.

Read the full report here.

New South Wales on track for first renewable energy zone

In November 2019 the New South Wales Government announced a plan to build three renewable energy zones. The first is planned for the central-west region assessed in the Baringa Partners report, located between Orange, Nyngan and Tamworth.

Construction of the 3000 MW renewable energy zone is planned to begin in 2022, with government predictions that it could unlock $4.4 billion of private sector investment.

LIKE THIS STORY? SIGN UP TO OUR NEWSLETTER

ARENA