This submission provides background information on projects funded by the Australian Renewable Energy Agency (ARENA) as relevant to the Independent Review into the Future Security of the National Electricity Market.

To assist the Expert Panel with its investigation, this submission outlines ARENA’s relevant experience with renewable energy generation, storage technologies, and their interaction(s) with the electricity system – both the secure and reliable operation of the grid, as well as the implications for market operations. The latter part of this submission outlines issues for market design and longer-term policy to help inform the Review’s areas of focus. The submission also outlines ARENA’s broader approach to enabling affordable, reliable electricity supply with a high proportion of renewable energy.

In summary:

- ARENA is focusing on innovation for secure and reliable electricity to help smooth the transition to a more renewable electricity system.

- As the proportion of solar and wind energy increases, supporting technologies will be needed.

- Many solutions are available, each with different characteristics: pumped hydro energy storage, batteries, concentrating solar thermal, bioenergy, demand response, and advanced controls for wind and solar, to name a few.

- Some of these are technically mature and used around the globe. There is also potential for further innovation in many technologies and approaches.

- In some cases, new or enhanced commercial signals will be needed to underpin investment. A long-term policy outlook will assist.

- More electricity will come from distributed resources in the future. This makes the operation of energy markets and incentives increasingly important. ARENA has funded microgrid and fringe-of-grid projects which can help illuminate this.

- Data on electricity demand and the system supports good policy and investment decisions. There are several complementary initiatives across government providing a good base to build on.

About ARENA

ARENA was established to make renewable energy solutions more affordable and increase the supply of renewable energy in Australia.

ARENA provides financial assistance to support innovation and commercialisation of renewable energy and enabling technologies. This assistance is designed to accelerate the commercialisation of these technologies by helping to overcoming technical and commercial barriers.

A key part of ARENA’s role is to collect, store and disseminate knowledge gained from the projects and activities it supports for use by the wider industry.

Flexible capacity and solutions for grid security and reliability

As the mix of electricity generation changes to a higher level of renewables, Australia’s electricity system will need to continue to provide secure, reliable power with more diverse, variable and distributed energy sources. This will involve a higher level of integration with flexible capacity, smart control systems, and improved technical standards to help maintain stability, and withstand unexpected and extreme events.

Flexible capacity includes storage, demand response, and generation that can be quickly ramped up and down to help balance supply and demand. As renewables like wind and solar PV get cheaper, ARENA is placing an increased focus on flexible capacity technologies to balance out variability in supply and demand as well as to maintain a stable electricity network.

Technical innovation and market evolution has already allowed Australia to move to higher levels of variable renewable generation than thought possible in past decades. This trend is expected to continue. For example, there is the potential for a wide range of technologies (both established and emerging) to provide ancillary services (such as frequency and voltage control) and inertia, both of which were traditionally provided by large, centralised generators.

ARENA’s project portfolio includes activities that facilitate greater penetration of renewable energy into low voltage grids, are testing customer-focused or behind-the-meter solutions, and address knowledge gaps to help develop market rules, regulations and network practices. One of ARENA’s investment priorities, Integrating Renewables and Grids (IRG), aims to support industry in developing, testing and commercialising a range of solutions that help to integrate increasing levels of variable generation.

ARENA supports a number of projects that aim to address these challenges including through:

- studies, models and tools that allow for technology and cost optimisation of the whole energy system (for example, through the Australian Renewable Energy Mapping Infrastructure);

- tools for renewable energy resource forecasting (for example, Fulcrum 3D’s cloud prediction technology, also used at Karratha Airport Solar Farm). This is especially relevant to the present inquiry given potential challenges in predicting both load and generation as both large scale and distributed renewable energy resources are deployed.

- distributed and utility-scale renewable energy storage (e.g. batteries, Concentrated Solar Thermal (CST), pumped hydro) to improve system-wide energy reliability and security (for example, through the AGL Virtual Power Plant);

- enabling distribution and transmission networks to accommodate high penetrations of both utility-scale and distributed energy resources (for example, through the TransGrid Renewable Energy Hub); and

- new market designs that help realise the full value of renewable energy (for example, through the Institute for Sustainable Future’s study into local electricity trading and local network charges).

Energy Storage

Wind and solar photovoltaics (PV) are currently the cheapest and most bankable forms of renewable energy in Australia with the current lowest cost projects less than $70 and $90 per megawatt-hour (MWh) respectively (on a levelised cost of energy basis). These two technologies are expected to continue to decline in cost through further research and development, supply chain maturity and experience (both local and international). A long term policy outlook will lead to lower costs because the cost of capital, which is a very significant portion of most large scale energy projects, will be lower. Reliable supply with high levels of wind and solar energy can be delivered through a combination of geographic diversity, excess capacity (allowing higher output when the wind is low or on a cloudy day), and other balancing resources like demand management and storage.

Balancing resources for grid security and reliability can take a number forms within a predominantly renewable network. This can include comparatively mature technologies such as pumped hydro and bioenergy to emerging technologies such as large scale batteries, concentrating solar thermal and hydrogen. Some grid support solutions, such as demand management and inverter technologies, are relatively mature from a technical perspective, but still commercially immature in an Australian context. A mix of these technologies can support the transition to a high renewable energy penetration in the electricity system in addition to other well known solutions such as greater interconnection and deployment of synchronous condensers.

A wide range of storage types are available, each with different characteristics, which suit different applications. ARENA is investing significantly in a variety of storage projects to test a range of technologies and new business models for provision of grid services that will enable a higher penetration of variable renewable generation.

The chart below is a simplified analysis of the various storage options available and the comparative “best use”. A mix of energy storage solutions will likely emerge, with the characteristics of each storage medium being suited to addressing specific market applications, scales and geographies.

ARENA’s current investment priorities in storage includes:

- demonstrating new business models and control systems for behind-the-meter applications to maximise the value and benefits of distributed renewable generation;

- grid-scale storage applications, to allow for higher penetration of renewables in future;

- overcoming barriers and improving access to information;

- reducing real and perceived risks;

- pilots and demonstration activities to address barriers to higher penetration of renewables or grid stability constraints; and

- research and development of technology and other solutions, particularly where relevant to Australian conditions.

ARENA has invested over $195 million across over 40 projects involving flexible capacity (including energy storage) or otherwise relevant to the review (see Attachment A). These include:

- off-grid demonstration projects that aim to prove reliability and control benefits of storage paired with renewables;

- a focus in some projects on new business models to facilitate the integration of renewables and grids;

- the allocation of a significant proportion of existing storage-related funding to concentrating solar thermal research and development, studies, and demonstration projects;

- a small number of projects focused on battery technology development; and

- projects investigating broader regulatory and consumer issues, such as the Future Proofing the Distribution Industry project led by the Clean Energy Council.

In addition, some projects using biomass feedstocks have the potential to provide flexible capacity available on demand.

Pumped Hydro Energy Storage

Pumped hydro electricity storage (PHES) is currently one of the more mature, readily available and economically viable technologies that could be deployed at sufficient scale to complement high levels of renewable energy in the national electricity grid. PHES works by transferring water from an upper reservoir to a lower reservoir (generating) during times of high demand and then pumping back up to the upper reservoir (pumping) during low demand times.

PHES power plants are not a new technology to Australia but there have not been any material projects in the last 30 years. The only three PHES projects in Australia are: Tumut 3 (1500MW) as part of the Snowy Hydro scheme; Wivenhoe Dam (500MW) near Brisbane; and the Shoalhaven scheme (240MW) south of Sydney. These three projects are dual purpose: they are used for electricity generation as well as water catchment management. This means the economics of these projects will not be directly comparable to the economics of dedicated facilities.

ARENA is supporting the Australian National University (ANU) to produce an atlas of potential sites for pumped hydro utility-scale storage. This will be accompanied by new information on the cost structures of ‘off-river’ pumped hydro systems and their integration into electricity grids. Off-river pumped hydro provides utility-scale, short term energy storage, with the potential to be constructed wherever there is suitable geographic elevation difference. Unlike traditional large-scale hydro electricity sources it does not need a large water supply and can operate independently of river systems.

By providing large-scale, rapid response energy storage, off-river pumped hydro can support electricity system reliability, for example to cover very occasional periods of extended cloud cover and low wind. Additionally, because it uses water flows to power a turbine, pumped hydro energy storage can provide the same grid stability services (such as grid inertia and frequency response services) as provided by traditional generators.

High level economics of PHES

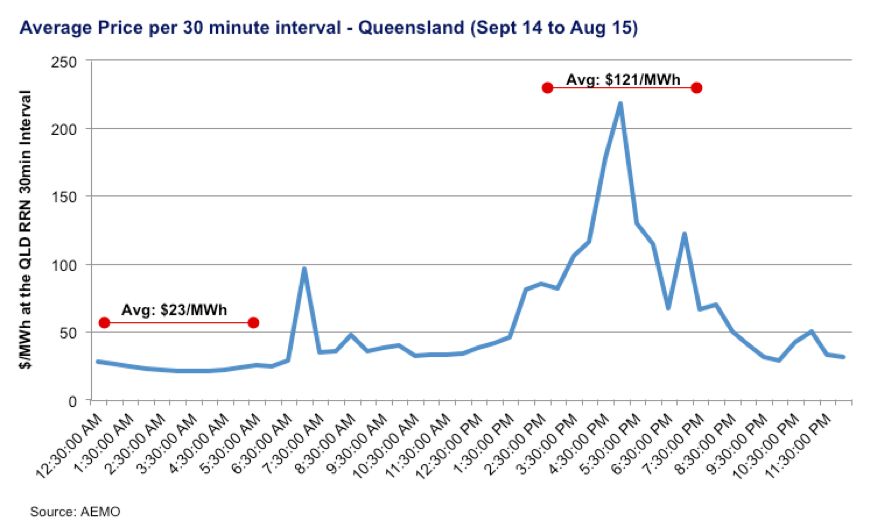

The chart below shows the average 30 minute electricity pricing in Queensland during the 12 months from September 2014 to August 2015. During low demand times, the cost of electricity over a 5 hour period averaged $23 per MWh. During high demand times, the cost of electricity over a 5 hour period averaged $121 per MWh. This indicates that during these periods of high demand, electricity generation is being supplied from higher cost generators – those that can provide flexible capacity.

As Australia transitions towards a higher penetration renewable energy system, the ability to meet potential larger variation between supply and demand will need to be supported with flexible capacity. The most established form of large scale renewable/net-zero-emissions flexible capacity is PHES.

For example, an upper reservoir filled with five million cubic metres of water, at an elevation 90 metres higher than a lower reservoir, contains approximately 1,000 MWh of potential energy. Fitted with a 200MW turbine, it could provide 5 hours of continuous energy. A 100MW turbine would provide 10 hours of generation. Assuming the reservoir was 20 metres deep, it would cover approximately 25 hectares. The relationship between head (height difference between upper and lower reservoirs) and energy stored is approximately linear, meaning sites with bigger differences will need smaller dams and smaller turbines to achieve similar storage and output.

PHES is not expected to experience any major cost reductions in the future due to the technology’s maturity and a material component of development cost relating to civil works. Current estimates indicate that an electricity system that relies on excess solar and wind capacity, geographic diversity, and PHES as the balancing technology (i.e. with no traditional thermal generation) would require a quantity of water (11GL) equal to just 0.3% of water that is currently used for for irrigation within the control of the Murray Darling Basin Authority.

While PHES technology itself is considered technically viable where there is sufficient water availability and suitable geo-formations, it will be more commercially feasible as more projects are built and different financing models are explored. While there are no recent reference sites in Australia to compare actual costs, a Melbourne Energy Institute paper estimates capital costs at between $100-200 per kWh of generating capacity, making it the cheapest form of large scale storage in Australia.

While there are emerging longer term economically viable options, PHES is a mature technology that is readily available at scale, however the lead times are long. PHES projects could take 4-7 years to develop and construct with the majority of cost associated with civil engineering and construction. As a result, ARENA would expect PHES projects to be complemented by a range of more smaller, rapidly deployed, lower capital cost flexible energy storage technologies.

Batteries

Batteries are a maturing and evolving technology with an unparalleled level of modularity. Batteries can be deployed at varying scales and with few constraints on location. Batteries are expected to continue on a cost trajectory not dissimilar to wind and solar PV, but it remains to be seen whether the deployment role will be localised (such as local network support, fringe of grid, etc) or wide scale (that is a long term, large scale storage at a competitive cost).

Attachment A identifies the projects in ARENA’s portfolio more detail on ARENA’s project portfolio involving batteries.

Concentrating Solar Thermal

ARENA continues to provide significant funding to a range of projects that are developing cost effective ways to collect and store heat from sunlight (solar thermal energy) to increase user confidence in solar energy, provide options for affordable and reliable electricity supply and heat for direct use.

ARENA supports research and development (R&D) of technologies that can store solar thermal energy and discharge it on demand to meet user needs. Concentrating Solar Thermal (CST) involves solar radiation being concentrated by lenses or mirrors onto a single point or receiver, which can then be converted directly into electricity or transferred as heat energy, through a heat transfer fluid, to an electricity generation system. Generation of electricity can use traditional steam turbines, typically used in existing coal-fired power plants.

While the levelised cost of CST is still comparatively high and bankability is challenging, technology development shows some promise for long term cost reductions. The business case for CST in electricity generation is likely to depend on its potential to provide a broader range of services beyond clean energy, such as dispatchable power using thermal energy storage, or ancillary grid support services. Similar to pumped hydro, these characteristics mean it could enable a high proportion of variable renewable generation with a high degree of electricity network reliability and security. CST is likely to be more efficient and competitive at larger scales (tens to hundreds of MW), meaning it is most likely to be part of a larger grid rather than as a distributed resource. There is some potential for direct use of heat at larger facilities, as illustrated by Sundrop Farms.

ARENA funds a number of R&D projects aimed at improving the efficiency and effectiveness of CST systems. One such major project is the Australian Solar Thermal Research Initiative (ASTRI). ASTRI provides an institutional framework for a coordinated, strategic, national approach to CST research in Australia. ASTRI coordinates a range of high-priority research activities, across CSIRO, the Australian National University, Flinders University, Queensland University of Technology, University of South Australia, the University of Queensland and the University of Adelaide with the aim of improving the competitiveness of CST systems.

ARENA is also funding the Vast Solar CST pilot plant, at Jemalong NSW, which is expected to be commissioned in 2017. It will demonstrate the reliable and safe operation of the Vast Solar CST system as a fully functioning pilot-scale power generation facility. Vast Solar is targeting CST generation at $100/MWh in the longer term.

ARENA is committed to reducing the cost of CST through R&D and demonstration to enable dispatchable electricity, by taking next generation R&D to an attractive point of commercial investment. This will provide a potential technology option for supporting grid security and reliability with a higher level of renewable energy.

Bioenergy

Bioenergy such as using sugarcane waste for electricity production, is a mature technology that has been used in Australia for decades. Alternative feedstocks and new efficient technology developments are expected to lower the cost and increase its use, but bankability and availability of feedstock will limit its ability to provide large scale and sufficient balancing capacity.

Demand Response

Demand response refers to energy users actively controlling when they use energy to help balance the overall supply and demand of electricity, making it another potential source of flexible capacity. Some ARENA projects use demand response as part of an overall integrated solution to enabling more renewables. For example, the Rottnest Island project includes active control of a desalination plant to make use of high levels of wind and solar energy.

Similarly a recent ARENA commissioned study by UTS ISF is undertaking a review of the current set of incentives for distribution networks to utilise utilise an array of demand management technologies including demand response. The purpose of the study is to assess whether there is a level economic playing field for networks when assessing the relative merits of network and non-network solutions to constraints. This study will provide important industry feedback into the AER’s current review of the demand management incentive scheme.

The ability for the demand side to provide frequency control ancillary services, including sub-second fast frequency response, has been demonstrated across multiple global markets including through the Special Protection Service in Tasmania. Demand response, amongst other demand side resources, is therefore likely to be a low cost, rapidly deployable resource critical to enabling system reliability and security as the penetration of renewable energy increases.

ARENA notes the ‘Demand Response Mechanism and Ancillary Services Unbundling’ rule change made by AEMC which we expect will encourage greater participation by commercial and industrial customers supported by specialist aggregators.

Microgrids, fringe-of-grid and off-grid

ARENA’s project portfolio also supports the development of microgrids. Microgrids are discrete energy systems, usually comprising distributed generation (such as solar PV), energy storage (such as from batteries) and demand management, which can be operated either independently of or in conjunction with the main grid. Applications include fringe-of-grid (for example, Lakeland Solar and Storage), remote off-grid (for example, Hydro-Tasmania’s King Island project) and new residential developments (for example, Brookfield Energy Australia’s Huntlee development).

Amongst other benefits, microgrids can allow communities and large energy consumers to continue operating as separate or ‘island’ networks, and so preserve power supply in the event that supply on the main grid is interrupted, for example, as a result of a loss of the network connection caused by a storm. The benefits of this kind of approach is highly dependent on the particular situation: for example, whether the location in question is particularly susceptible to network disruption, and how a microgrid solution would compare in cost and reliability. Microgrids will often work as a complement to a larger grid to maximise reliability, especially when the renewable resource within the microgrid is low (e.g. very occasional extended periods of cloud cover and/or low wind).

While advances have been made in the research, development and demonstration of off-grid, fringe-of-grid and microgrid technologies, there are still barriers that need to be addressed, particularly in relation to economic and regulatory requirements. Identifying sites where a stand-alone system could be cost-effective can also be difficult, as this will depend on the characteristics of the electricity network in a particular location. ARENA’s microgrid and off-grid portfolio seeks to inform these issues by showing the potential for high penetration, affordable renewable energy systems integrating generation, demand and network requirements.

Please refer to Attachment A for a list of ARENA-supported microgrid, fringe-of-grid and off-grid projects.

Considerations for Market Design to Support Security and Reliability

Ancillary services and inertia

The Expert Panel’s Preliminary Report has noted the reduction in the services historically provided by synchronous generation (namely frequency control ancillary services), and the reduction in system inertia that provides an inherent response to rapid frequency deviations. ARENA does not believe it will be necessary or appropriate to curtail variable renewable energy generation as a response to dealing with grid security issues (as flagged in question 4.2 of the Preliminary Report). Capping renewables in the short term would diminish the market signal for an increase in grid support services required. Under current market structures it is unlikely (and economically, it is undesirable) that the market would “over build” the required infrastructure for grid support services where renewable energy remains at low penetration and thermal generators are still in operation. Rather, providers of these support services will invest (presuming appropriate commercial arrangements are established) in response to increased total demand, and/or the withdrawal of other sources of supply.

Alternative technologies to traditional generators to provide frequency support are available, however, until recently either price signals, market access constraints and lack of prior experience have limited participation and competition. As noted above, the AEMC’s Demand Response Mechanism and Ancillary Services Unbundling rule change will make an important contribution to introducing greater competition in the FCAS market from demand side participants. AEMO’s work to update the services specification for market ancillary services will be important to address any barriers to entry. Further we would expect that the increasing value of FCAS will stimulate new entrants.

Several ARENA funded projects involving batteries will test FCAS participation. In addition, ARENA is working actively with market participants to test the technical capabilities and commercial feasibility of wind farm participation in the FCAS market. In response to question 4.3.2 in the Preliminary Report, we note that it is likely to be more efficient to centrally procure FCAS and other ancillary services, as many of these services are shared across the whole system. Rather than requiring all generators to provide ancillary services as standard, the continued use of efficient pricing mechanisms to incentivise provision of required services would appear prudent.

With regard to inertia (question 5.6 in the Preliminary Report), a system service previously provided at no cost by thermal generators, it is ARENA’s view that a price incentive of some kind should be provided for an inertia-like product, either to be provided by low emissions synchronous generators (eg. bioenergy, PHES or hydro, CST), or synthetic inertia provided by inverter connected technologies such as wind, solar PV and batteries or very fast demand response. In addition, a price incentive of some kind is likely to be appropriate for real inertia – which can only be provided by synchronous machines (synchronous condensers, traditional thermal generators, and new entrant low emissions generators such as bioenergy, PHES or CST).

Each of these services will contribute to the “value stack” that generators and storage operators will seek to access. It is unlikely that any single ancillary service will be provided on a stand alone basis, or of sufficient value to underpin new investment. The bankability of the projects and facilities (per question 5.6.1 of the Preliminary Report) will rely on a combination of electricity market participation, as well as access to revenue from existing and emerging grid services markets.

Flexible capacity and storage

Existing NEM market design implicitly includes a mechanism to value dispatchability: plant that is available to generate at times of tight supply-demand balance is able to realise higher revenue. However, aligning settlement timeframe with dispatch (5 vs 30 minutes) is important in order to reflect the economic contribution of fast-responding flexible capacity (whether that be demand response, storage or gas). We note the AEMC is currently considering a rule change proposal to align settlement with dispatch timeframes.

Financial markets provide a way to convert expected outcomes into more certain revenue streams. These include exchange-traded swaps and options (caps), and bilaterally negotiated (over-the-counter) products. Through ARENA’s involvement with the financing of large scale renewable generation and storage projects we observe there is commercial innovation occurring in the structure of dispatch rights for projects. Given the capital intensity and long life of some options, facilities might also be financed as part of a larger portfolio rather than on a stand-alone basis underpinned by financial contracts.

The market price cap review mechanism embedded in the National Electricity Rules provides an inbuilt way of addressing a key aspect of investability if not enough capacity is expected to come forward. It is not clear at this stage what changes might be needed – it will depend on how technology costs evolve over time, and on the abatement trajectory of the system. Nevertheless the method for calculating market price caps is well established and is described in, for example, Power System Economics by Stoft. Several projects with ARENA funding have looked at the robustness of the electricity market design with high levels of renewables and comparative economics of different policy mechanisms in the NEM. For example Riesz et al. identified that energy-only markets could be viable with high proportions of short-run marginal cost generation (such as most renewables), provided certain conditions are met: limited market power, a well-functioning financial contract market, and review of the market price cap. Least cost abatement papers by Jeppesen et al. and Brear et. al used the NEM’s current design and current market price cap. In contrast, Chattopadhyay et al. has suggested that adding a capacity component to the formal market design could provide a more economically efficient outcome with high levels of variable renewables where there is significant market power in the provision of thermal generation.

A long term policy outlook will reduce the forecast price at which investors will come forward, particularly in larger-scale capital-intensive projects such as pumped hydro or concentrating solar thermal. If certainty cannot be delivered, there is a significant risk of such investment failing to come forward when needed or of additional price pressures. For projects such as these it is critical investors have reasonable certainty on the potential for long term revenue to support commercial returns. Compared to open-cycle gas turbines, for example, a higher proportion of PHES costs relate to initial, upfront capital expenditure and less relates to ongoing operational expenditure. This makes the outlook on future revenues more important for the PHES investor, as this will determine the expected return on the upfront capital investment. Generators with lower comparative upfront capital expenditure but with exposure to high operational expenditure (such as fuel costs) are in some instances able to pass these costs on via variable revenue charges. The Finkel review, and the Government’s 2017 review of climate change policies, are an opportunity to extend the time horizon for policy-related drivers of energy market demand and pricing. Asset life extends well beyond current policy time horizons. Similarly, changes to transmission (specifically interconnector) investment criteria would have a significant impact on the long term economics of large scale PHES.

Distributed energy markets

ARENA is also exploring the design and operation of new markets for localised network services. The recently announced distributed energy exchange (deX) project will involve a consortium of networks and aggregators of customer owned DER providing localised network support in response to granular pricing. deX is a globally unique pilot that will test the capacity and cost effectiveness of aggregated DER to provide network support in response to local price signals, with residential and SME consumers sharing in the value of these services. This “peer to grid” market may provide an early blueprint for how a new market underpinned by regulation could best enable and incentivise the efficient orchestration of DER (question 4.4.1 of the Preliminary Report).

Another ARENA supported project, Networks Renewed by UTS is specifically investigating the capability of the latest inverters to provide network support services, in particular voltage support. This project will make an important contribution to demonstrating how variable renewables and enabling technologies can provide the grid services required to maintain a secure and reliable electricity system. The increasing potential for network support services to be provided by devices that also provide services in competitive markets (whether for consumers directly or as part of wholesale markets) suggests it is increasingly important that network companies face balanced incentives for capital and operating expenditure.

The Networks Renewed and deX project ideas were developed through ARENA’s grid integration innovation process A-Lab, described further below.

Data to underpin good decisions

ARENA has invested in the open-source Australian Renewable Energy Mapping initiative to bring together datasets useful to potential renewable energy investors. This includes pre-competitive data on energy resources, electricity network characteristics, and existing generation. Data on the drivers of energy demand, such as that being collected through the Commonwealth Government-funded Energy Use Data Model, is also critical to inform good policy design and the forecasts that underpin energy investment decisions. We expect there will be opportunities to harmonise and extend the scope of datasets such as these over time so that decisions reflect overall optimal system outcomes.

A-Lab: Energy System Innovation

A-Lab is ARENA’s grid integration innovation lab. It draws on a network of people with a wide range of expertise and passion to drive systemic change in the electricity sector. A-Lab provides a space for these people to explore and define solutions to the most complex challenges of integrating renewables and grids, combining their respective strengths and building momentum for change.

Why did ARENA establish A-Lab?

Our research to explore and create A-Lab uncovered that despite the energy sector’s focussed effort on research and understanding the challenges associated with the transition to a low carbon energy system, there was no dedicated resource to facilitate systemic innovation. There was no shared venue or established collaborative working method.

Our research found that stakeholders individually could not innovate across the entire system, and there was a need and desire for a facilitated opportunity to engage strategically and systemically.

A-Lab is the forum to drive systemic innovation. A-Lab can provide the space, people and methods to make genuine inroads towards an affordable, reliable and low carbon electricity ecosystem of the future.

How does A-Lab work?

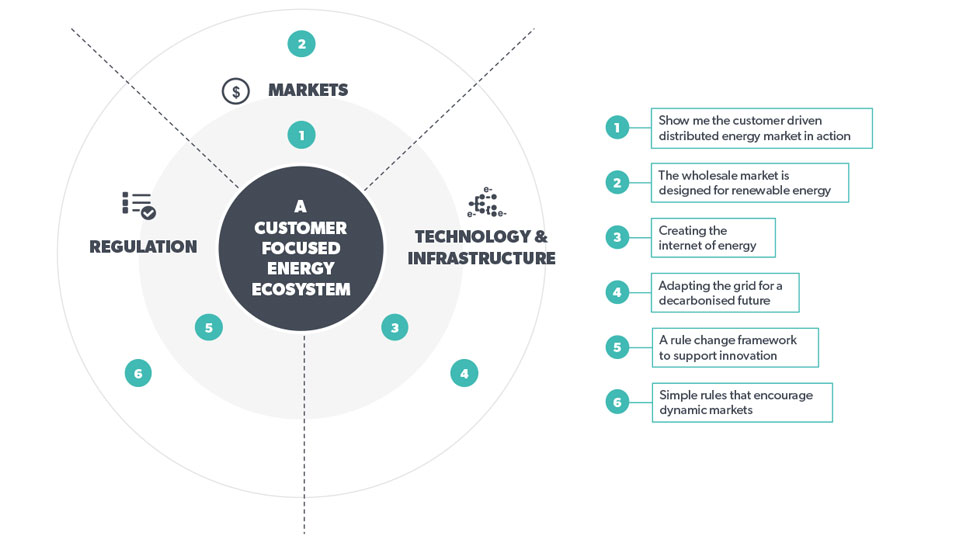

After undertaking research involving in depth stakeholder interviews and a review of existing research, publications and industry initiatives, ARENA, through the A-lab process, developed a set of six Innovation Frames that balance the need for a reliable and resilient system; vibrant new markets and choices; social equity; and low carbon impact.

Each Innovation Frame will be used to shape a period of work for A-Lab around a particular theme. The six frames encapsulate the current opportunities and needs for innovation to enable the energy sector to be transformed to meet the future vision of a low carbon energy system. Central to ARENA’s vision for A-Lab is to not only understand the technical, commercial and regulatory challenges described in those Innovation Frames, but to take a people-centred approach to the transformation of the electricity system.

For each of the Innovation Frames, ARENA will work with participants to better understand the system, the drivers of change, competing or conflicting priorities and opportunities for innovation. A-Lab uses a disciplined innovation process to help participants design solutions, projects and experiments more rapidly, collaboratively and with the whole system in mind. These projects can then be presented to ARENA, and others, for funding support. Through this process we aim to build on ARENA’s existing portfolio with projects that address key issues identified and have the potential to create systemic change.

What has ARENA done so far?

In 2016 we began the initiative with an intensive co-design and pilot process working across the industry. The initial focus was designing and testing approaches to new, customer oriented distributed energy markets (Innovation Frame 1 – ‘show me the customer drive distributed energy market in action’). This pilot phase has already moved us from theoretical constructs to the tangible projects that will make our energy future more affordable, reliable and renewable. The recently announced decentralised energy exchange, or deX, is one of the initial A-Lab designed projects that will test the operation of a new market for customer-owned DER providing network services. Work on additional frames is underway.

A-Lab’s six innovation frames

ARENA believes that A-Lab can enable industry stakeholders to develop practical solutions to the challenges posed by the electricity system’s transformation. We would welcome the opportunity to work closely with the Expert Panel and Review team to explore how A-Lab can be used to deliver tangible projects, demonstrations, studies and trials to test the solutions and recommendations that emerge from the Review process.

Attachment A: Selected ARENA-supported storage, flexible capacity and integration projects

| Company | Sub-category | Project Name | Description | ARENA funding |

| Synergy | Battery system trial (residential) | Solar and storage trial at Alkimos Beach residential development | This project involves developing, deploying and testing the commercial feasibility of a new energy retail model. It will combine community scale battery energy storage, high penetration solar photovoltaics (PV) and energy management within a new residential development at Alkimos Beach in Western Australia. | $3,300,000 |

| Reposit Power | Battery system trial (residential) | A commercially viable application of electricity storage for Australia’s national electricity grid | The project involves piloting GridCredits, a battery storage control module that allows consumers to monitor electricity usage and access their solar power overnight and at peak times. | $445,666 |

| Ergon Energy | Battery system trial (residential) | Trialling a new residential solar PV and battery model | This project involves Queensland energy provider Ergon Retail undertaking a pilot demonstration to test a commercial and operational model for providing grid-connected solar photovoltaic (PV) and battery storage systems to residential customers. The demonstration will involve installing and testing 33 systems in Cannonvale, Toowoomba and Townsville. | $400,000 |

| AGL | Battery system trial (residential) | AGL Virtual Power Plant | Roll-out and virtual aggregation of 1,000 Sunverge residential battery systems, equivalent to a 5MW power plant. | $5,000,000 |

| AGL | Battery system trial (utility) | Energy Storage for Commercial Renewable Integration | This project is examining the role of medium to large scale (5-30MW) energy storage in the integration of renewable energy into the South Australian electricity system. | $445,846 |

| University of Adelaide | Battery technology | Energy storage test facility and knowledge bank | This project will build a mobile energy storage test facility and establish an online database for Australian energy storage expertise. These resources will provide industry and researchers with a capability to independently test entire energy storage systems and with a central source for existing and future knowledge. | $1,441,811 |

| University of Technology Sydney | Battery technology | Develop lithium-sulphur batteries for large-scale electrical energy storage | This project aims to develop advanced lithium-sulfur batteries for renewable energy storage with high energy density, extended service life and operation safety. | $750,000 |

| Ecoult | Battery technology | UltraBattery Distributed Solar PV Support and UltraBattery for RAPS | This project will apply CSIRO’s breakthrough UltraBattery® technology to deliver superior energy storage solutions. | $553,780 |

| IT Power | Battery technology | Testing the performance of lithium ion batteries | This project will analyse the performance of six major lithium-ion battery brands, comparing them to existing and advanced lead-acid battery technologies to demonstrate how they could operate in large and small electricity grids. | $450,000 |

| Neoen | Off-grid hybrid power project | DeGrussa Solar Project | The project involves the construction of a 10.6 MW solar PV installation with 6MW of storage at the DeGrussa Copper Mine. The solar and storage will provide the majority of the mine’s daytime electricity requirements, offsetting more than 20% of total diesel consumption. | $20,900,000 |

| Energy Developments Ltd (EDL) | Off-grid hybrid power project | Coober Pedy Renewable Diesel Hybrid | This project will construct 1MW solar PV, 4MW wind generation together with an uninterruptible power system, dynamic resistor for stability and integrating control system. This technology will be integrated with Energy Developments Ltd’s (EDL) existing 3.9MW diesel power station and provide electricity according to the 20 year power purchase agreement (PPA) with the District Council of Coober Pedy. When completed the project will achieve annual diesel fuel savings of approximately 70%. | $16,048,132 |

| First Solar (Australia) | Off-grid hybrid power project | Weipa Solar PV Project | The project will construct and operate a 6.7MW solar photovoltaic (PV) solar farm in two stages at Rio Tinto’s remote bauxite operation in Weipa. The system will connect to Rio Tinto’s existing mini-grid at Weipa and deliver electricity according to a long term Power Purchase Agreement (PPA). | $11,300,000 |

| Hydro Tasmania | Off-grid hybrid power project | Hydro Tasmania King Island Renewable Energy Integration | The project aims to use a combination of solar, wind, diesel, storage and enabling technologies to displace more than 60% of Flinders Island’s diesel generated energy. Hydro Tasmania will develop a modular hybrid energy solution with the potential to further drive down costs and move a step closer to delivering a commercially competitive product. | $6,083,000 |

| Hydro Tasmania | Off-grid hybrid power project | Flinders Island Energy Hub | The project uses a combination of solar, wind, diesel, storage and enabling technologies to displace more than 60% of Flinders Island’s diesel generated energy. Hydro Tasmania will develop a modular, containerised hybrid energy solution with the potential to further drive down costs and move a step closer to delivering a commercially competitive product that can balance supply and demand of electricity in real time | $5,500,000 |

| Lord Howe Island Board | Off-grid hybrid power project | Lord Howe Island Renewable Project | The project will add a combined 1 MW of renewable energy generating capacity to the current diesel power generation system operating on Lord Howe Island. | $5,300,000 |

| SunEdison Australia | Off-grid hybrid power project | Karratha Airport | This project involves the design, construction, commissioning and operation of a 1 MW solar photovoltaic (PV) facility with cloud predictive technology (CPT) at Western Australia’s second-largest airport Karratha Airport. The City of Karratha, which owns Karratha Airport, will enter into a 21 year power purchase agreement (PPA) with the solar plant. | $2,300,000 |

| Genex | Pumped hydro | Kidston Pumped Storage Project | This feasibility study involves the construction of a pumped storage hydroelectric power plant at the disused Kidston Gold Mine in North Queensland. Located 280km north west of Townsville, the project has the potential to generate up to 330 MW of rapid response, flexible power for delivery into Australia’s National Electricity Market. | $4,000,000 |

| CSIRO | Solar thermal | Australian Solar Thermal Research Initiative (ASTRI) | ASTRI is a consortium of leading Australian research institutions collaborating on ‘over the horizon’ concentrating solar power (CSP) research projects in close partnership with US research organisations and leading CSP companies. | $35,000,000 |

| Vast Solar | Solar thermal | Vast solar 6MW (thermal) grid connected multi-module CST plant with thermal storage | This project will provide evidence of the reliable and safe operation of the Vast Solar CST system in a fully functioning pilot power generation facility, in readiness for the demonstration of Vast Solar’s system at full commercial scale. | $4,966,960 |

| CSIRO | Solar thermal | Advanced solar thermal energy storage | This project involved CSIRO working with Spanish company Abengoa to find cost-effective ways to collect and store heat from sunlight (solar thermal energy) in order to increase user confidence in solar energy, minimise disruption to the electricity grid and make it more economic for solar power plants to produce electricity. | $3,538,846 |

| ANU | Solar thermal | High-temperature solar thermal energy storage via manganese-oxide based redox cycling | This project aims to develop an innovative energy storage system that uses concentrating solar thermal technology to drive a high-temperature redox (or reduction-oxidation) thermochemical cycle. | $1,193,534 |

| Barbara Hardy Institute | Solar thermal | Development of high temp phase change storage system and test facility | This project involved the development of high temp phase change storage system and test facility | $689,500 |

| Abengoa Solar Power Australia | Solar thermal | Feasibility study for Perenjori 20MW Dispatchable Solar Tower Project | A feasibility study into the construction of a 20 MWe solar thermal power station which would employ Abengoa’s molten salt tower technology with a thermal energy storage system. | $449,718 |

| AUSTELA | Solar thermal | Potential Network Benefits of Solar Thermal Generation in the NEM | This study was undertaken to quantify the potential benefits of installing CSP generation at constrained network locations in the National Electricity Market (NEM). | $179,965 |

| Clean Energy Council | Study | Future proofing in Australia’s Electricity Distribution Industry | This project aims to enhance the flexibility and resilience of Australia’s electricity distribution system. The Clean Energy Council will conduct extensive consultations with industry, government, regulators and consumers, and commission technical, economic and regulatory analysis | $877,900 |

| CSIRO | Tool development | Virtual Power Station 2 | This project builds on CSIRO’s existing research, creating the next version of a virtual power station (VPS2) that can undertake pilot-scale testing of load, generation and energy storage coordination. | $850,000 |

| Lakeland Solar and Storage Pty Ltd | Large scale solar plant with battery storage | Lakeland solar and storage project | This project involves the construction of a large scale solar plant with battery storage in the Lakeland region of North Queensland | $17,419,000 |

| Carnegie Wave Energy Ltd | Microgrid | Garden Island Microgrid Project | The project will involve the construction and integration of 2MW of solar PV capacity, a battery storage system and a control system with CETO 6 wave energy generation technology to form a microgrid to operate either independently or in conjunction with WA’s electricity network. | $2,500,000 |

| Hydro Tasmania | Off-grid hybrid power project | Rottnest Island Water and Renewable Energy Nexus | The project will construct and connect 600kW of solar PV to the existing power system on Rottnest Island (WA) and extend the capabilities of the existing assets (through advanced control systems and innovative demand side management) to reduce diesel consumption and use excess renewable energy to produce potable water. | $4,800,000 |

| Smart Storage Pty Ltd (Ecoult) | Battery storage | Project Fulfil | The project aims to advance the technical aspects and commercial value of Ecoult’s UltraBattery for specific renewable energy applications. It will focus on delivering an affordable and reliable battery monitoring and management system for operating lead-acid batteries in partial state of charge (PSoC) applications, as well as developing interfaces and tools to enable use of the system with existing inverters, and predictive analytics to improve network integration. | $4,100,000 |

| Indigenous Essential Services Pty Ltd | Off-grid hybrid power project | Northern Territory Solar Energy Transformation Program (NT SETuP) | The project will integrate 10 MW of solar PV into with existing diesel power stations in up to 30 remote locations in the NT. The majority of sites will achieve 15% diesel fuel displacement from a total 9 MW of solar PV only. One high penetration site will integrate 1MW of solar PV and a battery energy storage system with the existing diesel power station at Daly River (Nauiyu), achieving around 50% diesel fuel displacement. SETuP is designed to transform PWC’s current practices so renewable energy is considered ‘business as usual’ in the future. | $27,500,000 |

| Brookfield Energy Australia Pty Ltd | Microgrid | Delivering higher renewable penetration in new land and housing developments through off-grid microgrids | The project aims to explore the commercial viability and impact of renewable energy for large new housing developments with off-grid microgrids | $442,000 |

| Moreland Energy Foundation Limited | Microgrid | Moreland microgrid investigation | The project will undertake a virtual trial based on historical power consumption data from medium density Melbourne suburbs to examine how a grid-connected solar PV and storage system could provide behind the meter power needs of users. | $112,400 |

| ANU | Pumped Hydro | An Atlas of Pumped Hydro Energy Storage | The project is a desktop study that will undertake analysis and develop and share knowledge on the potential for Short Term Off-River Energy Storage (STORES) using pumped hydro technology as a low cost mass storage option to assist high penetration of solar and wind energy in Australian electricity grids. | $449,000 |

| Curtin University | Solar with battery | Increasing the uptake of solar photovoltaics in strata residential developments | Development of governance models to allow shared solar PV, battery, and monitoring systems in apartments and testing on units in the White Gum Valley Development. | $900,000 |

| Windlab | Wind, solar, storage | Kennedy Energy Park | This project is is a hybrid renewable energy facility situated in Hughenden in North Queensland developed in a partnership between Windlab and Eurus. This project will consist of 23.0MW DC / 19.2MW AC solar photovoltaic (PV), 21.6MW wind and a 2MW/4MWh lithium ion battery storage facility. | $18,000,000 |

| UTS | Battery storage | Lithium-sulfur batteries for large scale electrical energy storage | This project aims to develop advanced lithium-sulfur batteries for renewable energy storage with high energy density, extended service life and operation safety. | $750,000 |

| University of Wollongong | Battery storage | Smart sodium storage system for renewable energy storage | This project will develop and integrate a new type of sodium-ion battery in a low-cost, modular and expandable energy storage system to be demonstrated at the Illawarra Flame House and Sydney Water’s Bondi Sewage Pumping Station. | $2,707,000 |

| Monash University | Study | Pathways to deep decarbonisation in 2050 | This project explores the role of renewable energy technologies and biofuels in decarbonising the Australian economy. The project is jointly led by ClimateWorks Australia and the Australian National University and draws on the latest research and modelling by CSIRO and Centre of Policy Studies at Victoria University. | $305,893 |

Attachment B: Further discussion of PHES opportunities.

Genex Power’s PHES project

ARENA is currently supporting Genex Power as part of its proposal to develop and build Australia’s newest PHES project at the disused Kidston Gold Mine in Queensland. The project is modelled at 250MW with 6 hours of storage capacity for 1,500MWh of potential generation capacity utilising a “turkey’s nest” structure (a turkey’s nest is an artificially lined low depth but high surface area dam constructed by building up on top of existing land). As a comparison, the Wivenhoe Dam has 10 hours of storage capacity for 5,000MWh of potential generation capacity.

Other opportunities

The Kidston PHES Project is one of the more advanced PHES development projects in Australia with number of other sites in the early stages of development. There is potential to implement PHES across a number of regions in Australia, where there is elevation differences of 200m or more. Project feasibility assessment and early development work would benefit from enhanced planning and permitting pathways that help de-risk the right to develop a proposal.

Desktop studies have been completed by a number of experts on PHES and the Australian market with current studies being supported by ARENA, namely the ANU PHES mapping project being undertaken by Dr Andrew Blakers. Current indications suggest that using “turkey’s nest” PHES sites (like that of Genex Power) and coastal seawater sites shows significant potential, in particular around the coastal cliffs of the Eyre Peninsula and the deep valleys of the Hunter/Illawarra/lower Blue Mountains regions of New South Wales.

A 2012 ROAM study identified 68 potential PHES sites in the NEM which could deliver 516GWh of potential flexible capacity, or put another way, meet the average demand in the NEM for over 20 hours. Whether all of the 68 sites could meet stringent regulations and socially acceptance was not explored in depth. The study did not look at off-river “turkey’s nest” options as this would have opened up the potential options to thousands of sites. In addition there is the potential to use old underground mines for PHES ( ie dewatering them and then flooding them again from an above-ground reservoir).

EnergyAustralia Cultana seawater PHES facility

ARENA is in negotiations with EnergyAustralia to determine initial feasibility and design regarding a potential PHES facility located in the Cultana region of South Australia. Initial work by EnergyAustralia (and partners) has identified a site that appears to be appropriate in terms of elevation gain, proximity to the coast and proximity to an existing electricity transmission line. The proposed project consists of a purpose built upper reservoir (several hectares in size), approximately 2km of penstock piping to a turbine at sea level, and input/output pipes into the sea. Determining system size will be part of the feasibility study, but is expected to be 100MW–200MW.

One of the aims of the feasibility study is to look at grid balancing opportunities, taking power from the grid at times of low spot prices and retuning power to the grid at times of high prices, as well as providing frequency control ancillary services and other potential future ancillary services possible due to the synchronous characteristics of PHES. The study is expected to cost approximately $1 million, of which $450,000 is expected to be provided by ARENA.

Download full submission here.